Introduction:

In the ever-evolving landscape of Indian e-commerce, Meesho has emerged as a formidable player, overshadowing industry giants such as Amazon, Flipkart, and Myntra during the Diwali festive sales of 2023. According to a comprehensive report by conversation media platform Bobble AI, Meesho’s stellar performance is attributed to a surge in open rates, increased penetration in tier 2 and tier 3 towns, and a significant rise in transacting users.

Report Overview:

Bobble AI’s market intelligence (MI) unit meticulously analyzed the performance of four major e-commerce platforms – Amazon, Flipkart, Myntra, and Meesho – during the Diwali festive sales of both 2022 and 2023. The study, conducted with privacy-compliant methods using data from over 85 million devices, focused on key metrics such as open rate, install penetration, average sessions per user (ASU), transacting users (TU), and new installs (NI).

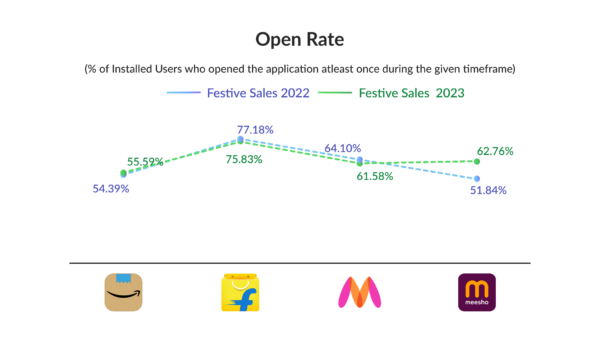

Open Rate:

The report indicates that while the open rates of competing apps remained relatively constant over the two years, Meesho experienced a remarkable 11% jump in its open rate during this period. This surge was particularly pronounced in tier 2 and tier 3 towns, with increases of 11.92% and 13.48%, respectively. This points to Meesho’s growing appeal in less urbanized areas, setting it apart from its competitors.

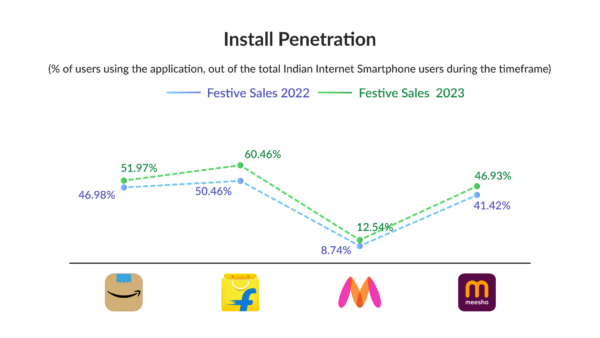

Install Penetration:

Among the e-commerce giants, Flipkart recorded the highest rise in app penetration, with a notable 10% increase. Meesho followed closely behind with an increase of over 5%. The heightened install penetration of Flipkart was fueled by growing demand in tier 2 and tier 3 towns, reaffirming the trend that the performance of e-commerce apps is significantly influenced by these regions. Meesho’s strong showing in these areas positions it as a key player challenging the dominance of established platforms.

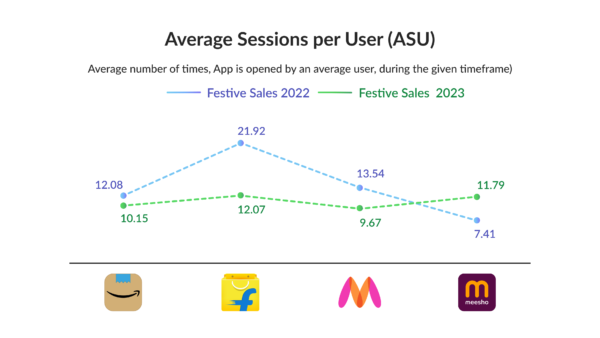

Average Sessions per User (ASU):

ASU metrics provide insights into user engagement with e-commerce platforms. The data indicates a 45% decrease in ASU for Flipkart and a 29% decrease for Myntra. In stark contrast, Meesho experienced a substantial 59% increase in ASU during the Festive Sales of 2022. This suggests that Meesho is not only attracting a larger user base but also fostering higher engagement levels, a crucial factor in the competitive e-commerce landscape.

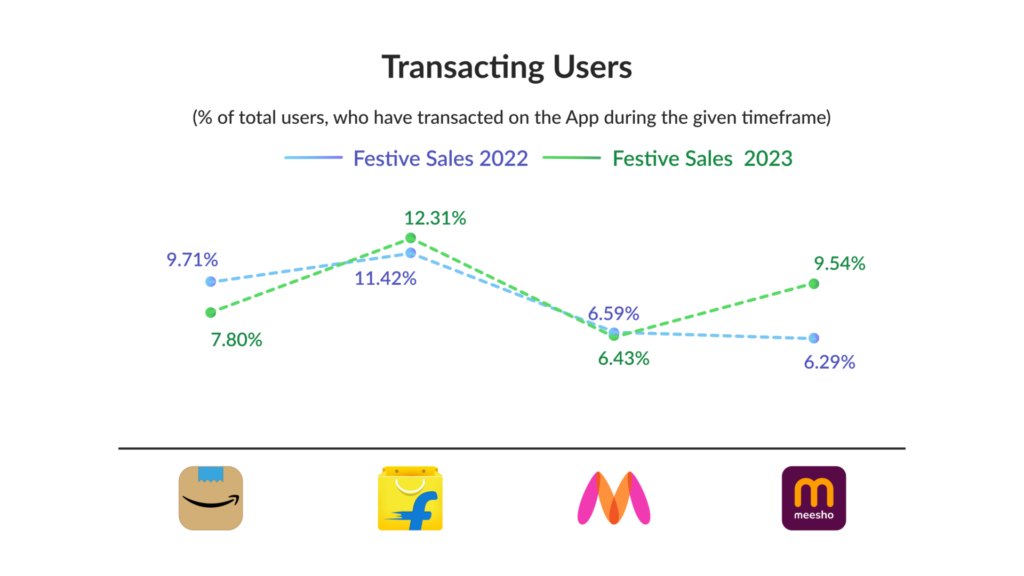

Transacting Users (TU):

The TU metric sheds light on the business generated on a platform. Meesho exhibited the highest increase in transacting users, soaring from 6.29% to 9.54% – nearly a 50% surge compared to the previous year. Flipkart followed suit with an increase from 11.42% to 12.31%. Conversely, Amazon and Myntra experienced a drop in TU, with Amazon falling from 9.71% to 7.80% and Myntra from 6.59% to 6.43%. Meesho’s robust performance in this critical metric indicates a growing customer base actively making transactions on its platform.

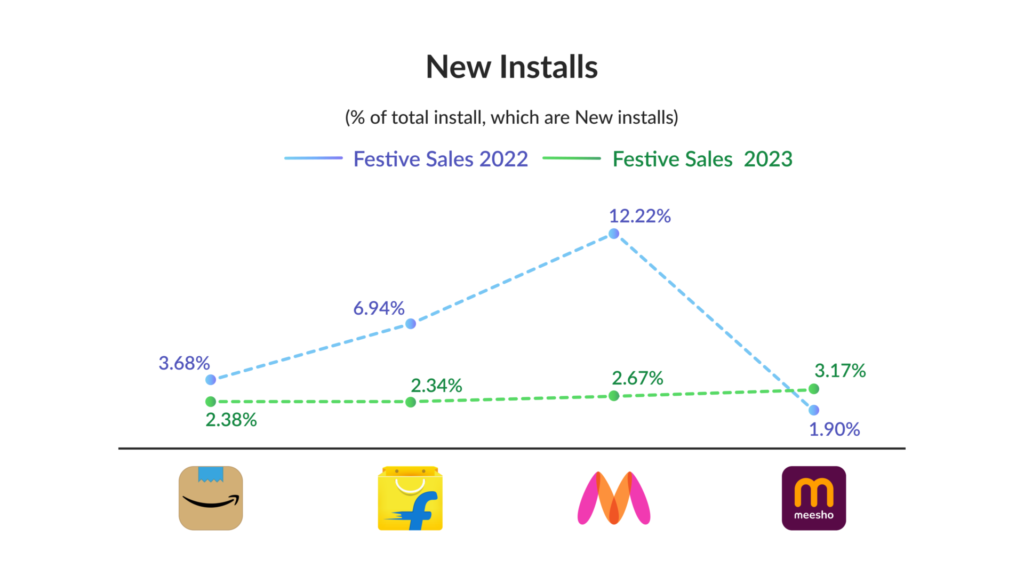

New Install (NI):

The NI metric gauges the increment in users over a specific period. The comparative analysis of NI for Bobble users between the Festival 2022 and Festival 2023 periods revealed a contraction in NI for Myntra by around 10% and Flipkart by over 4%. In contrast, Meesho emerged as the leader with a remarkable increase of over 65% across the two periods, jumping from 1.90% to 3.15%. This underscores Meesho’s ability to attract and retain new users at an impressive rate.

Changing Dynamics:

The report establishes that Meesho’s rapid ascent is driven by the trust of tier 2 and tier 3 customers. This shift in dynamics poses a substantial threat to the duopoly of e-commerce giants heavily reliant on the purchasing capacity and trust of Tier 1 customers. Despite Flipkart recording the highest increase in penetration, Meesho outshone its competitors in open rates, transacting users, and various other metrics, signaling a significant transformation in the Indian e-commerce landscape.

Conclusion:

As Meesho continues to disrupt the traditional narrative of e-commerce in India, the industry’s power dynamics are undergoing a notable transformation. The platform’s emphasis on tier 2 and tier 3 towns, coupled with impressive growth across key metrics, positions it as a serious contender against established giants like Amazon, Flipkart, and Myntra. With Meesho’s unwavering momentum, the e-commerce landscape in India is witnessing a paradigm shift, challenging the status quo and heralding a new era of competition and consumer trust.